Automate hundreds of

business decisions in

seconds

Sign up for free and get 5 free business credits to use instantly

Business credit check data provided by Creditsafe

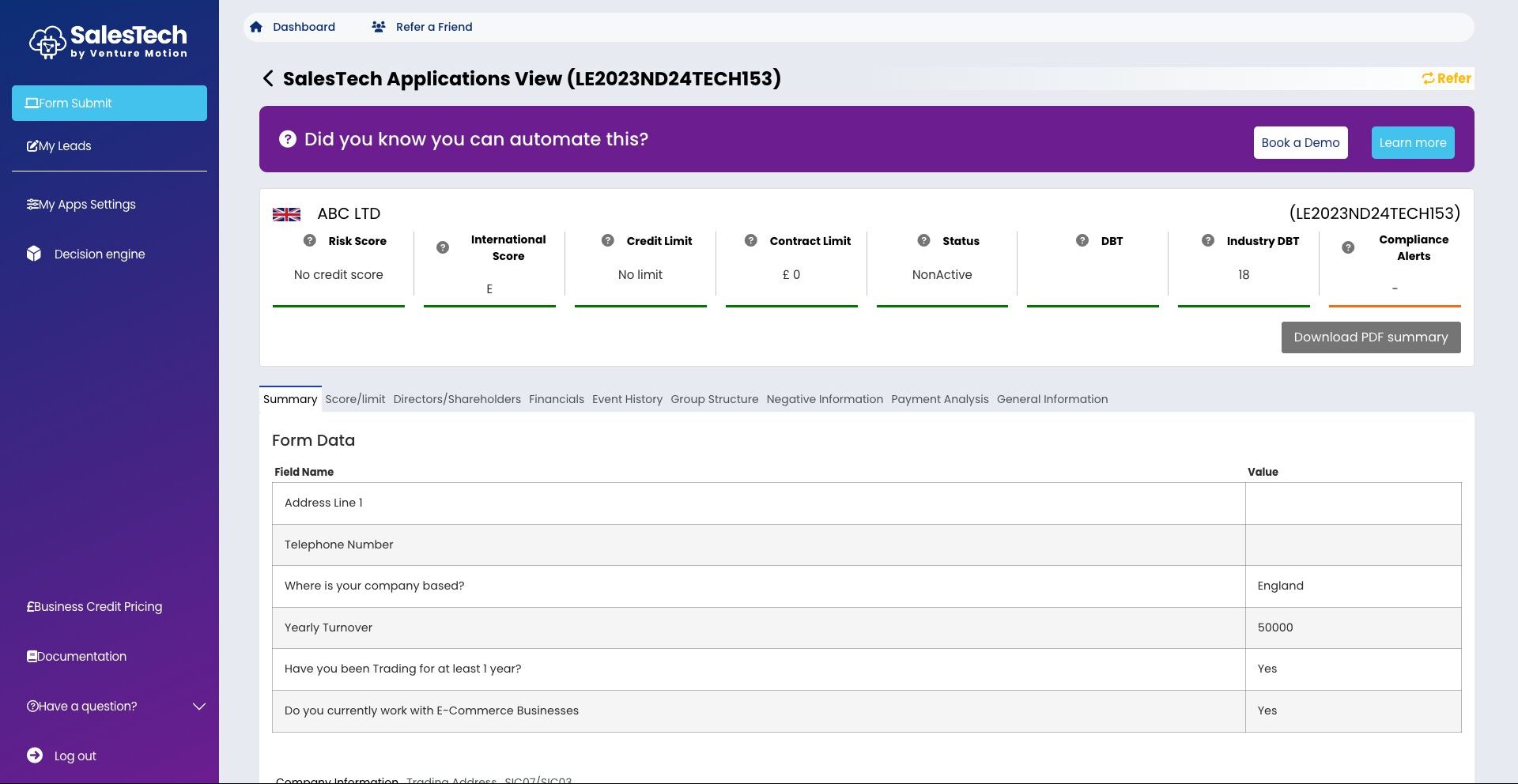

Powered by the leading global provider of business credit reports, our Creditsafe checks offer accurate and reliable data of millions of businesses across the UK, putting lenders and brokers in the best position to make well informed lending decisions.

Learn more

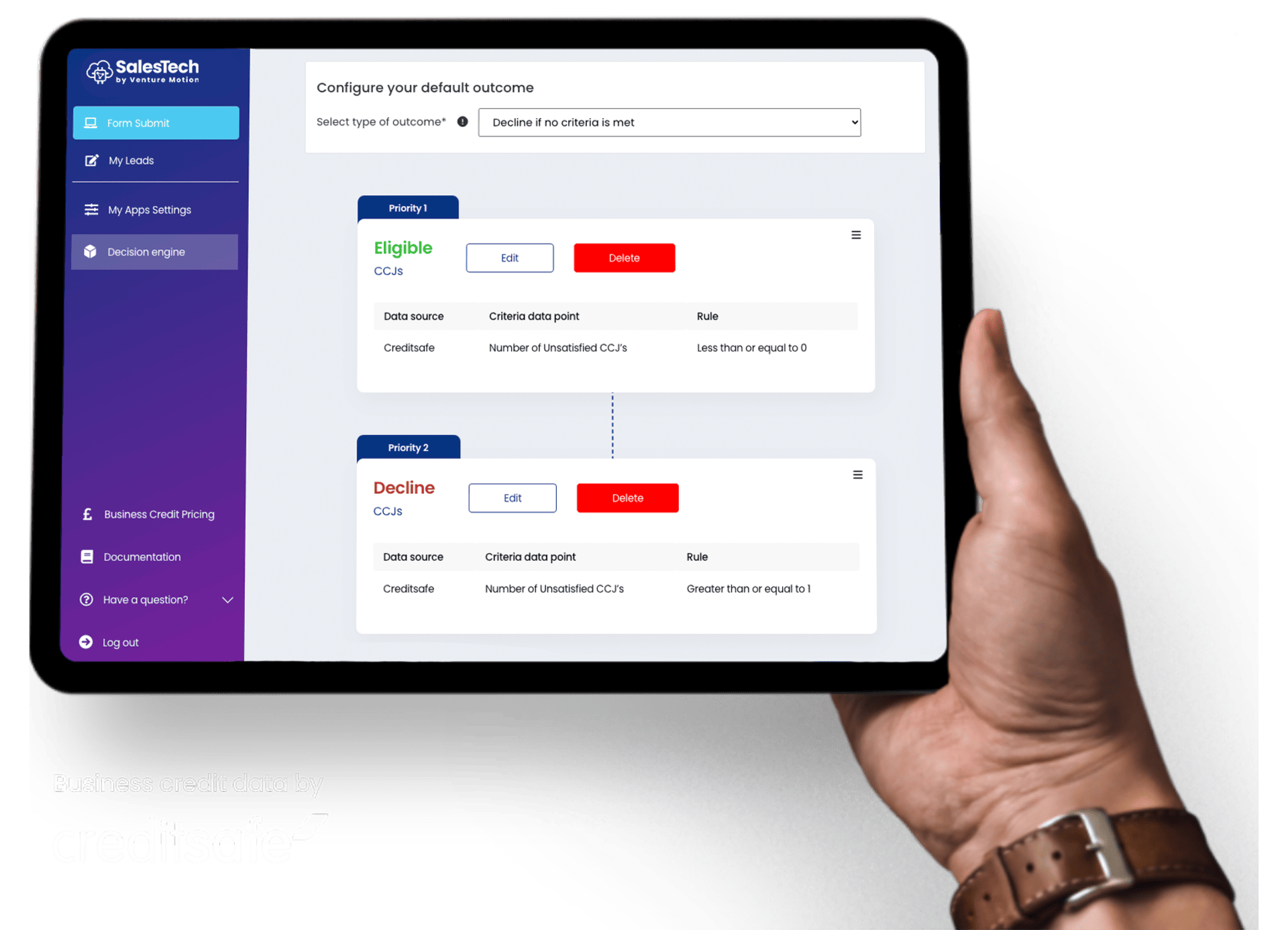

A fully adaptable lending decision engine

The SalesTech platform is fully adaptable to the specific needs of your business. Whatever your requirements, our straightforward system will allow you to add and remove data points to build an entirely bespoke business decision engine.

Learn more

Streamline your applications

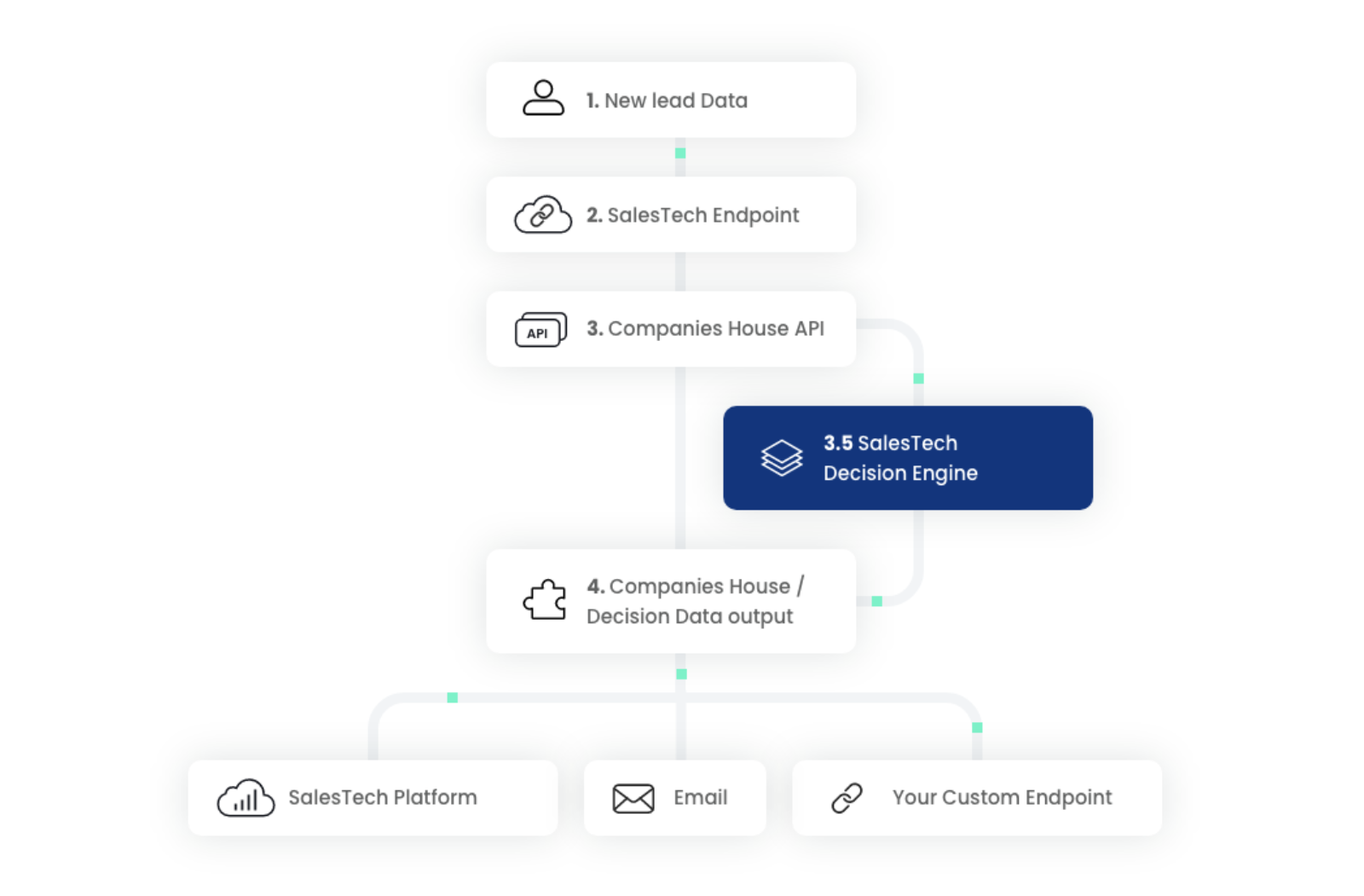

The API gives the platform access to a range of data points to help you make the correct decisions for your business including, but not limited to: Credit and risk score, credit and contract limits, financial data, director and shareholder details.

Learn more

Enrich your data with our Companies House API

Our Companies House API allows you to access all of the data in their system in real time. This gives you the ability to instantly enrich the information you have on your business customers by automatically accessing the company information your processes rely on. Your know-your-customer and know-your-business process will be more streamlined than ever before.

Learn moreInstant, reliable & accurate business credit reports powered by Creditsafe

SalesTech gives your business full access to the Creditsafe database. Offering detailed company profiles, financial performance data and a host of credit score information all within one platform. Try our interactive demo and learn now you can instantly process and business credit check within seconds.

Follow the instructions on the interactive demo to learn how to process a business credit check with LendTech.

Follow the instructions on the interactive demo to learn how to process a business credit check with LendTech.

How our Companies House API works

Our Journey

“We spent over 10 years working with a wide range of B2B lenders and brokers, building solutions and understanding the industry challenges and pain points. Off the back of this, we saw a recurring high demand for instant, reliable business credit checks and automation processes to qualify leads, contributing to and allowing lenders and brokers to focus on high quality leads, and this is how SalesTech was born.”

Terry Chiu – Venture Motion Director

Set custom criteria with SalesTechs fully

integrated decision engine

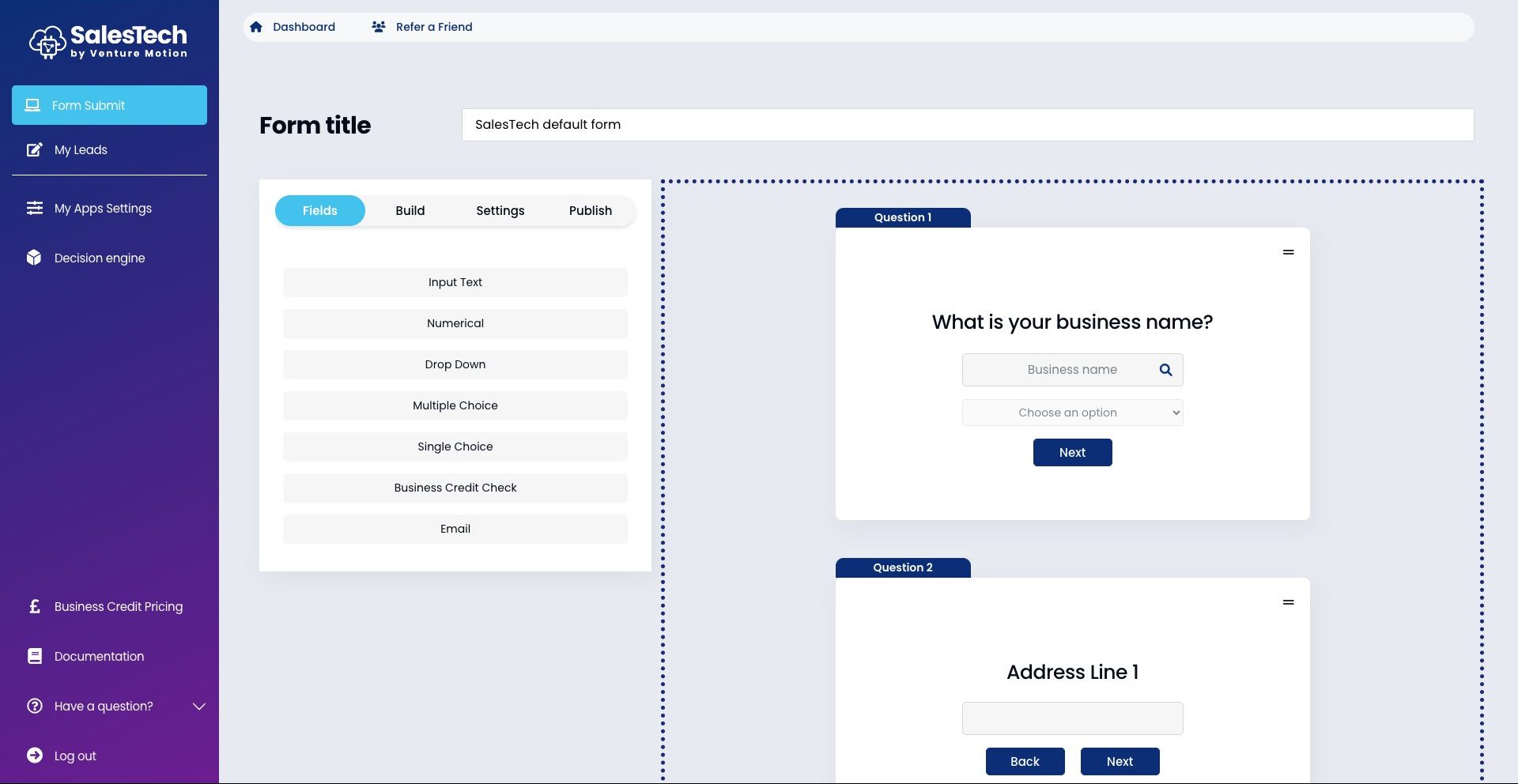

SalesTech gives you the ability to set and validate criteria against custom form fields and Creditsafe’s data points ranging from business credit scores to shareholder funds. With our fully integrated decision engine you can automate and instantly qualify or decline applicants, freeing up your time to focus on high quality leads. Try the interactive demo and learn how easy it is to add decision engine criteria.

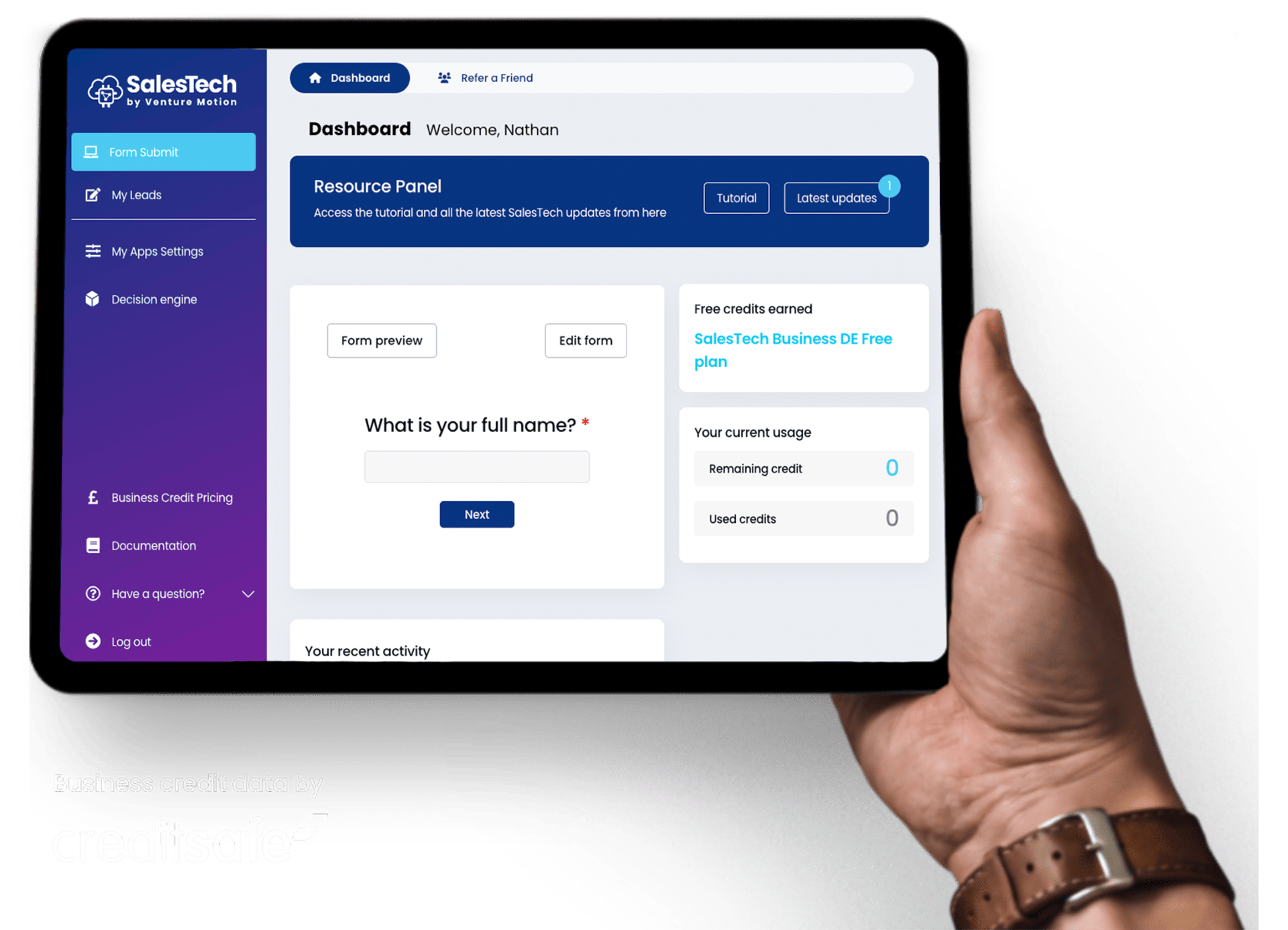

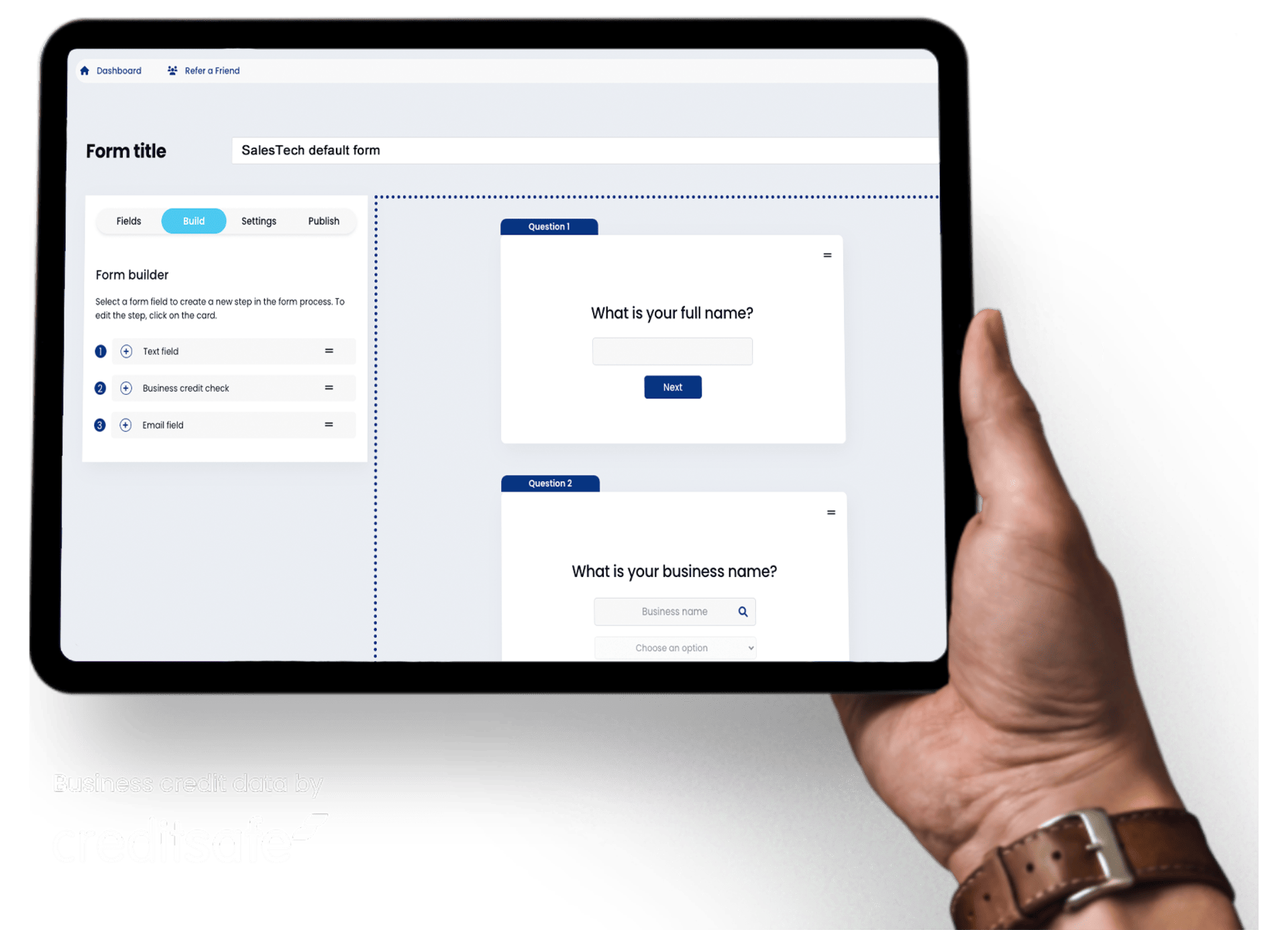

Overhaul your KYC process with SalesTechs custom form builder

Our fully integrated form builder gives you the ability to enhance and efficiently streamline your KYC process with a range of form fields. Embed your form directly onto your website and enjoy the benefits of feeding your customer data directly into the decision engine with seamless business credit checking integration.

Usage & SalesTech plans

Buisness credit checks

All our business credit checking plans include the decision engine. Use the slider to input the amount of business credit checks you require per month and we’ll recommend the best plan for your needs.

25

Credit searches

Recommended plan

SalesTech Business DE 300 Plan

What’s included?

Data includes

Powered by

All plans are 12 month fixed contracts. Pay annual plans are paid in full prior to the activation of the plan and will give you access to the total amount of search credits. Pay monthly plans split both the payments and total search credits allowance into 12 equal instalments.

All plans are 12 month fixed contracts. Pay annual plans are paid in full prior to the activation of the plan and will give you access to the total amount of search credits. Pay monthly plans split both the payments and total search credits allowance into 12 equal instalments.

FAQs

No. SalesTech caters to both technical and non technical users. At its core, SalesTech is a plug and play platform meaning you don’t need to have any technical abilities to get started. If you’re unsure about anything or need help, we offer a free onboarding call that involves helping you set up your account, configuring your form and decision engine when you sign up to a SalesTech plan. We’ll also answer any questions to put your mind at ease. To get started simply sign up today or book a demo with one our SalesTech experts.

SalesTech business credit reports are powered by Creditsafe, giving you instant access to the credit data of over 6 million UK limited and non-limited businesses. The data points range from credit scoring and CCJ data to address history company financial data.

SalesTech is a lending automation platform that hosts CRM capabilities ranging from unlimited storage facility of processed leads to customer profiling. SalesTech also features a fully integrated decision engine and form builder enhancing your KYC operations, decision making and underwriting.

SalesTech is a free to use platform. Every new user will receive 5 free business credits to that can be used instantly. You will also get access to the fully integrated form builder and decision engine.

Users that sign up to a paid plan will receive a monthly or annual allowance of business credit checks depending on the selected plan. Paid users will also benefit from receiving a full onboarding and configuration introduction by a SalesTech specialist along with 24/7 technical support.

Yes, SalesTech is free to sign up. No card details is required to create a free account. Get started and try free today.